In the article about income statements under marginal cost, we discussed that marginal costs give a higher net profit figure as compared to absorption costing. Here, we are going to discuss the income statement under absorption costing and see how the net profit differs. Before we look at the income statement, let us have a look at what absorption costing is. Absorption costing is the accounting method that allocates manufacturing costs based on a predetermined rate that is called the absorption rate. It helps company to calculate cost of goods sold and inventory at the end of accounting period. Both the above methods are accounting techniques that companies use to allocate the cost of production over the total number of units produced.

New Segment Reporting Disclosures

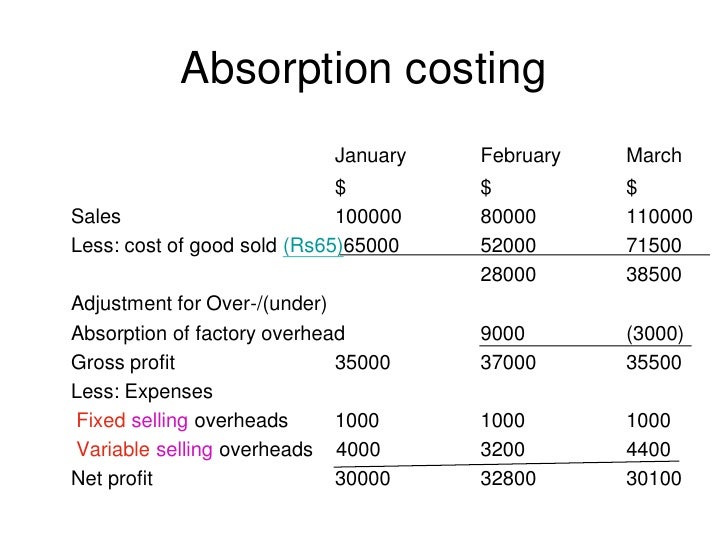

Moreover, the method can provide a more stable basis for performance evaluation, as it avoids the potentially misleading cost fluctuations that can arise from only considering variable costs. When doing an income statement, the first thing I always do is calculate the cost per unit. Under absorption costing, the cost per unit is direct materials, direct labor, variable overhead, and fixed overhead. In this case, the fixed overhead per unit is calculated by dividing total fixed overhead by the number of units produced (see absorption costing post for details).

Chapter 6: Variable and Absorption Costing

- Once you have the cost per unit, the rest of the statement is fairly easy to complete.

- Calculate the unit cost first, as that is the most difficult portion of the statement.

- It includes all product costs, which are both fixed and manufacturing product costs.

- Careful COGS calculation as per GAAP standards is essential for accurate financial reporting.

- Managers can manipulate income by changing the number of units produced Producing more products gives a higher income.

Unlike variable costing, it covers fixed costs and inventories while calculating the cost per unit. If the bicycle company produced 10 bikes, its total costs would be $1,000 fixed plus $2,000 variable equals $3,000, or $300 per unit. Although fixed costs do not vary with changes in production or sales volume, they may change over time. Each unit of a produced good can now carry an assigned total production cost.

Net Income Determination in Absorption Costing

This artificially inflates profits in the period of production by incurring less cost than would be incurred under a variable costing system. Under the absorption costing method, all costs of production, whether fixed or variable, are considered product costs. This means that absorption costing allocates a portion of fixed manufacturing overhead to each product. The adoption of absorption costing has direct implications for a company’s tax liabilities.

Key Principles of Absorption Costing

Advocates of absorption costing argue that fixed manufacturing overhead costs are essential to the production process and are an actual cost of the product. They further argue that costs should be categorized by function rather than by behavior, and these costs must be included as a product cost regardless of whether the cost is fixed or variable. Under absorption costing, the inventory carries a portion of fixed overhead costs in its valuation. This means the cost of ending inventory on the balance sheet is higher compared to variable costing methods. Compared to variable costing, absorption costing income statements tend to show less volatility in operating income from period to period. This is because fixed costs are smoothed into COGS rather than impacting the period they are incurred.

Variable costing considers the variable overhead costs and does not consider fixed overhead as part of a product’s cost. It is not in accordance with GAAP, because fixed overhead is treated as a period cost and is not included in the cost of the product. While companies use absorption costing for their financial statements, many also use variable costing for decision-making.

Calculate the unit cost first, as that is the most difficult portion of the statement. Absorption costing is typically used in situations where a company wants to understand the full cost of producing a product or providing a service. This includes cases where a company is required to report its financial results to external stakeholders, such as shareholders or how to estimate bad debt expense regulatory agencies. Include an amount for “other items,” which is the difference between the total relevant expense caption on the income statement and the aggregate of separately disclosed expense categories. An ethical and evenhanded approach to providing clear and informative financial information regarding costing is the goal of the ethical accountant.

Absorption costing is an accounting method that captures all of the costs involved in manufacturing a product when valuing inventory. The method includes direct costs and indirect costs and is helpful in determining the cost to produce one unit of goods. Additionally, absorption costing can obscure the true variable cost of production, making it more challenging to conduct break-even analysis and perform cost-volume-profit (CVP) analysis. Managers seeking to make decisions based on the marginal cost of production may find the data less accessible, as fixed costs are distributed across units regardless of the actual production level.

The absorption cost per unit is the variable cost (\(\$22\)) plus the per-unit cost of \(\$7\) (\(\$49,000/7,000\) units) for the fixed overhead, for a total of \(\$29\). Despite its widespread use and compliance with accounting standards, absorption costing is not without its detractors. One of the primary critiques is that it can potentially distort a company’s financial performance, particularly in the short term. By deferring the recognition of fixed costs, absorption costing can inflate profits in periods of increasing inventory, which may not accurately reflect the economic reality of a company’s operations. This can lead to decisions that prioritize production over market demand, resulting in excess inventory and potential write-downs in the future. The service sector presents a different set of challenges for absorption costing due to the intangible nature of its products.