When combs are manufactured, plastic is moved into production as a raw material. Since the combs are only partially completed, all costs are posted to WIP. When the combs are completed, the costs are moved from WIP to finished goods, with both accounts being part of the inventory account. Costs are moved from inventory to cost of goods sold (COGS) when the combs are eventually sold. What makes this method a “weighted average” is that performance last period affects costs in future periods (it will at least affect costs this period and next period).

- These 9,000 units will end up in one of two places, either completed and transferred out (to the Finishing department) or not completed and therefore in ending WIP inventory.

- Each department or production process or batch process tracks its direct material and direct labor costs as well as the number of units in production.

- The accountant can then compare the real-world data with the financial metrics to make sure everything checks out.

- Manufacturing software continually tracks the location, status, and progress of all work processes, automatically aggregates material, labor, and overhead costs, and allocates them to individual manufacturing orders.

Manufacturing Overhead

The weighted average firm just doesn’t care that some “completed units” are actually beginning WIP units that already had some work done on them last period. Instead the weighted average method completely detaches beginning WIP costs from partially-complete beginning WIP units. Beginning WIP units get lumped in with all “Completed Units” as if they had no work at all done last period. At the end of the period, the firm determines ending WIP percent completion and determines units completed.

Loading Job…

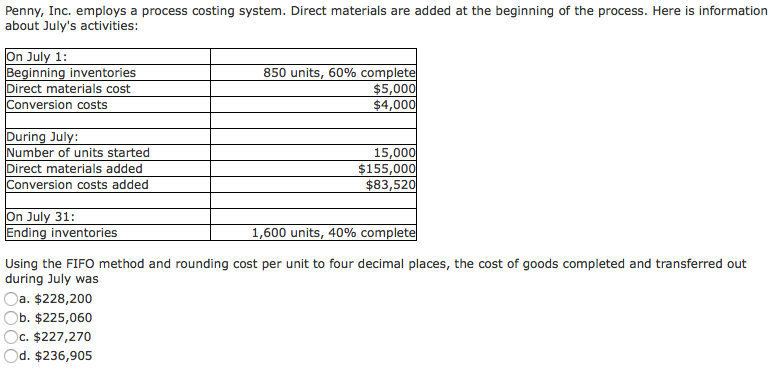

Each month, the data at the top are changed to reflect the current month’s activity, and the production cost report takes care of itself. Kelley Paint Company uses the weighted average method to account for costs of production. Kelley manufactures base paint in two separate departments—Mixing and Packaging. The following expense ratio calculator the real cost of fees information is for the Mixing department for the month of March. In the first stage of production, Coca-Cola mixes direct materials—water, refined sugar, and secret ingredients—to make the liquid for its beverages. The second stage includes filling cleaned and sanitized bottles before placing a cap on each bottle.

Frequently Asked Questions

The process and flow of WIP inventory are important to understand because they can indicate how efficient your supplier or manufacturer is at producing finished goods. By working closely with your supplier and other partners in your retail supply chain, like a 3PL company, you can find ways to optimize the supply chain. The cost of WIP inventory is a bit more complex than determining the value of finished goods, as there are many more moving parts.

It is difficult to tell the first drumstick made on Monday from the 32,000th one made on Thursday, so a computer matches the sticks in pairs based on the tone produced. As such, the difference between WIP and finished goods is based on an inventory’s stage of completion relative to its total inventory. WIP and finished goods refer to the intermediary and final stages of an inventory life cycle, respectively. ‘Finished goods’ inventory are items that have been completed by the manufacturer and are ready to be sold for revenue. Brands in the US can leverage ShipBob’s Inventory Placement Program (IPP) to speed up transit times and lower shipping costs. IPP automatically distributes and places inventory throughout the US and fulfills orders from the fulfillment center closest to the end customer.

How Do Managers Use Production Cost Report Information?

We had to “top off” the beginning WIP units this period to complete them. So the cost of beginning WIP, the first-in and first-out portion of the units completed and transferred out is reflected below. If you sum the three ending WIP products above, you have the total cost of ending WIP. If you sum the three units completed products above, you have the total cost of units completed and transferred out.

WIP inventory should be kept at “just the right size” – big enough to ensure consecutive processes can flow optimally and small enough to avoid it piling up and tying up extra cash. To achieve this, WIP needs to be continuously managed and tracked throughout the manufacturing process. Designing optimized storage and shop floor layouts and considering WIP inventory volumes already in the production planning phase is also a must.

Even two sticks made sequentially may have different weights because the wood varies in density. Understanding the company’s organization is an important first step in any costing system. The sticks are dried, and then sent to the packaging department, where the sticks are embossed with the Rock City Percussion logo, inspected, paired, packaged, and shipped to retail outlets such as Guitar Center. The shaping department completed 7,500 units and transferred them to the testing and sorting department.

Rock City Percussion uses a process cost system because the drumsticks are produced in batches, and it is not economically feasible to trace the direct labor or direct material, like hickory, to a specific drumstick. Therefore, the costs are maintained by each department, rather than by job, as they are in job order costing. In supply-chain management, work-in-progress (WIP) refers to goods that are partially completed.

Basic resources are rolled into a factory, followed by loud noises and a smoking chimney. On their journey toward becoming final products, raw materials go through work in process inventory. Process costing and job order costing are both acceptable methods for tracking costs and production levels. Some companies use a single method, while some companies use both, which creates a hybrid costing system. The system a company uses depends on the nature of the product the company manufactures.