Since cash was paid out, the asset account Cash is credited and another account needs to be debited. Because the rent payment will be used up in the current period (the month of June) it is considered to be an expense, and Rent Expense is debited. Once you get the hang of which accounts to increase and decrease, you will be able to record purchase returns and allowances in your books. A high or increasing percentage can reduce profits and undermine operational efficiency. When a product is physically returned, it increases inventory and decreases related cost of goods sold recognized at the time of sale.

Steps to Record a Sales Revenue Journal Entry

When recording sales, you’ll make journal entries using cash, accounts receivable, revenue from sales, cost of goods sold, inventory, and sales tax payable accounts. Therefore, sales returns should not cause too much concern for companies. However, it should alarm the business if the sales returns and allowances account is increasing because ultimately, this will result in a decrease in the company’s revenue and income. In short, a sales allowance does not involve a physical return of goods.

Journal Entry for Credit Sale:

Businesses should also venture into studying the latest product trends to keep up with the demands of the market. An open line of communication between businesses and customers will also be helpful so that customer concerns are properly taken care of before a sales return happens. Companies that sell physical goods may also offer sales returns policies. Usually, these companies produce the goods or acquire them from an external source. After production or acquisition, they hold these goods as inventory until customers order them.

- The sales allowance is granted to buyers for the above-mentioned reasons, whereas the sales discount is granted for quick and timely payments.

- The sale return account is created for recording the sale that is returning from the customer.

- Please note that accounts receivable is credited in case of Club B because the amount was still outstanding at the time of the sales return.

- The accounting entries to record revenues from the transaction were as follows.

- High return levels may indicate the presence of serious but correctable problems.

Cash Sales Journal Entry

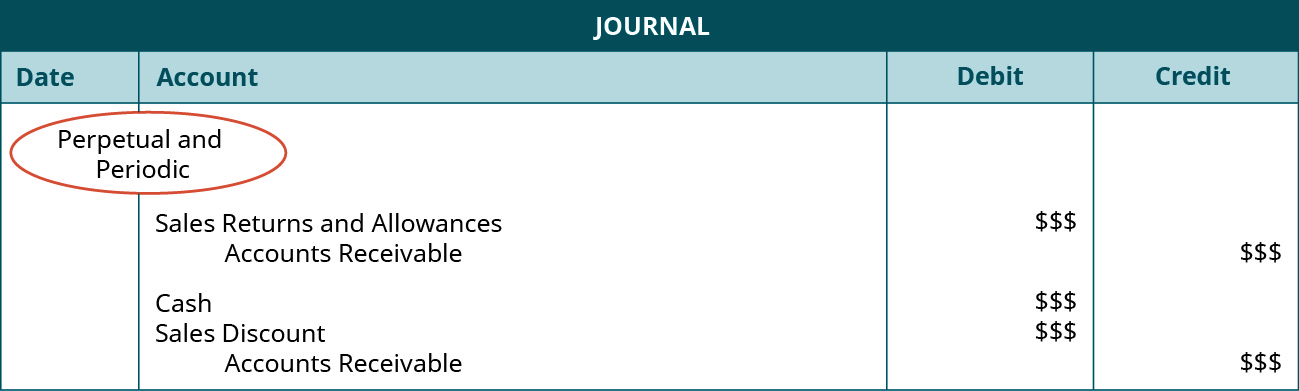

Moreover, two separate accounts are dedicated in the general ledger to account for each. Sales returns and allowance are the contra account to the sales revenues where the previously recognized sales need to be derecognized by recording into this account. If it were the credit sales, then we should credit to the account receivable account. If the sales were cash sales, we should credit them to the cash or bank account since the company will need to pay back to the customer. Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues. The sale is recorded by debiting the appropriate asset account (Cash or Accounts Receivable) and crediting the Sales Revenue account.

Similarly, it will include the terms and conditions for which the returns will be acceptable. Revenues define the income from a company’s operations during an accounting period. These revenues may arise from the sale of either goods or services. Regardless of a r factoring definition why factor types of factoring their source, revenues play a significant role in a company’s profits and success. Therefore, companies strive to increase the numbers as high as possible. It usually appears as a line item in the income statement that shows the reduction in gross sales.

Understanding the meaning of each debit and credit can be tricky when you’re dealing with returns. In the next section, we’ll talk more about what each debit and credit means for the sale entry. Because you are not immediately paying the customer, you must increase the amount you owe through an Accounts Payable entry. In most cases, the customer receives a refund when they physically return the good.

Net sales revenue is equal to gross sales revenue minus sales discounts, returns and allowances. Revenue accounts – all revenue or income accounts are temporary accounts. These accounts include Sales, Service Revenue, Interest Income, Rent Income, Royalty Income, Dividend Income, Gain on Sale of Equipment, etc. Contra-revenue accounts such as Sales Discounts, and Sales Returns and Allowances, are also temporary accounts.

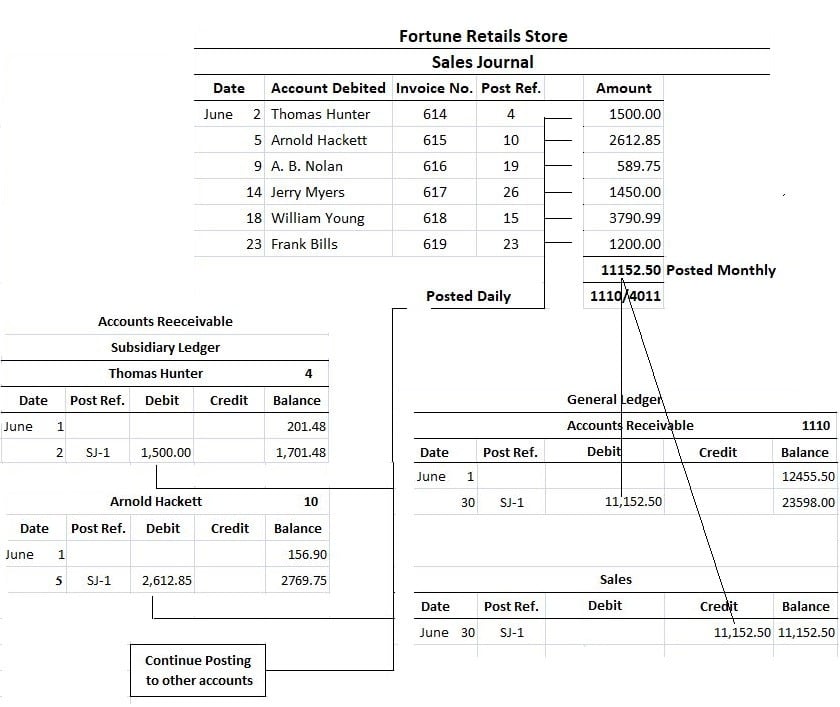

Hence, the company usually use sales returns and allowances account to record the total amount of sales return transactions for review and monitoring purposes. Record the following transactions in the sales journal and sales returns and allowances journal, and post to the ledger accounts. It also affects the balance sheet through changes in cash or accounts receivable and equity (via retained earnings). Accurately recording this entry is essential for assessing the company’s performance, profitability, and financial health. To close Sales, it must be debited with a corresponding credit to the income summary. Sales Discounts and Sales Returns and Allowances are both contra revenue accounts so each has a normal debit balance.